We are moving….

We are moving to our new site.

For latest news and updates, please go to http://www.aboutsingaporeproperty.com

Yio Chu Kang site for sale

THE Urban Redevelopment Authority (URA) has launched a commercial and residential site for sale by public tender.

The land parcel, located at Yio Chu Kang Road and Seletar Road, has a site area of 2.1 hectares and is designated for a mixed commercial and residential development.

Interested developers must submit a bid of at least $40.5 million for the plot of land.

Two weeks ago, URA said it received an application from a developer which has committed to putting in a bid above the minimum price.

Previously, the land parcel had been made available for sale through the Reserve List System.

Under this system, a site would be released for sale only if a bid with an acceptable minimum price is received.

Source: Today, 21 Aug 2009

End of self-regulation?

IT HAS been long overdue but yet it’s more than welcomed, say real estate players on news that the Ministry of National Development (MND) will begin consultations for a new regulatory framework for the real estate industry from next month.

Top on the wish-list of these real estate stakeholders is to see a licensing scheme for housing agents and the formation of a formal regulatory body which has the authority to settle disputes and reprimand errant agents. Industry players also said this may mark a shift in the Government’s long-held position that the industry should self-regulate.

National Development Minister Mah Bow Tan has hinted at mandatory regulations for the industry since March, calling the whole system “not satisfactory” and the status quo “not tenable” after the emergence of several unethical practices by housing agents.

“The industry review seeks to achieve two objectives: One, to enable consumers to better safeguard their interests, and two, to increase the professionalism of the real estate industry,” said the MND in a press release yesterday.

On this point, vice-president of Dennis Wee Group Chris Koh said the industry has been “waiting for the Government to give directions”.

To Mr Koh, the most important element in the new framework would be a “stick” to punish errant agents. “I’ve heard of agents who have passed examinations, but are still unethical. What happens is if they do something wrong, and I fire them, they can just join another organisation.”

Another suggestion is to create an official body to regulate the industry, overseeing matters like enforcement and a national database of real estate agents. According to the MND, there are some 1,737 housing agencies licensed by the Inland Revenue of Singapore as of July this year. There are no official figures for the number of individual housing agents, but estimates are about 25,000 to 30,000.

“Today, if I’m a consumer and I have a complaint with an agent, I don’t know who to go to,” said president of the Institute of Estate Agents Jeff Foo.

MND said it will look at areas such as qualifications and training requirements to increase the professionalism of property agents, and an improved dispute resolution mechanism. An enforcement framework against agencies with errant agents is also being explored.

After consulting real estate professionals, MND will ask the public for feedback on its proposed new framework for the industry. The consultation process is expected to be completed by November.

Source: Today, 21 Aug 2009

Rights of all owners adequately protected

I REFER to last Saturday’s letters by Mr Dennis Butler (‘En bloc sales: Adopt HK’s 50-year limit’) and Mr Augustine Cheah (‘The difference’).

In 1999, the Land Titles (Strata) Act was amended to allow collective property sales by majority consent. One of the key considerations in this amendment was to facilitate urban renewal and avoid situations where a small minority of owners can hold up the sale of the development where the use of the land could be optimised.

We have taken steps under the Act to ensure the rights of all owners are adequately protected and provide recourse for those who feel aggrieved for any reason. For example, all collective sales applications have to be considered by the Strata Titles Board. Minority owners who object to the sale can raise their objections to the board, and the board is required to consider these objections before it decides on the outcome of the sales application.

In 2004 and 2007, we refined and updated the Act to provide more safeguards to owners in a collective sale process. For example, owners will have a mandatory five-day cooling-off period after signing a collective sales agreement to reconsider their consent.

Mr Butler has suggested that only developments that are more than 50 years old should be considered for collective sale redevelopment. It would be too rigid to set such an age limit. There could be other factors that warrant redevelopment like its state of disrepair. It is better to leave it to the owners in each development to determine the viability and timing of collective sales.

The current policy has resulted in a better use of our limited land to create more quality housing units for Singaporeans.

For example, the 390-unit Goldenhill Park Condominium sits on the site formerly occupied by the 95-unit Goldenhill Condominium; and the 100-unit The Ansley used to be occupied by the 44-unit Mandalay Court. These former developments were less than 50 years old at the time of the collective sale and redevelopment – Goldenhill Condominium was 15 years old and Mandalay Court was 31 years old. Collective sales also offer a viable alternative for owners to seek new accommodation with new and better facilities.

We thank Mr Butler and Mr Cheah for their feedback. The Ministry of Law will continue to monitor the impact of collective sales rules, and would review the law as and when appropriate.

Source, Straits Times 21 Aug 2009

Property agent review under way

Better regulation and new training and exam requirements expected

TOUGHER powers to nail dodgy operators and new ways to solve disputes with home buyers are some of the recommendations expected from a review of how estate agents go about their business.

Industry experts also expect the government appraisal to outline new training and exam requirements for agents entering the business.

The impetus for the review – the report will be made by the end of the year – has come from the real estate sector itself, with leading players lobbying the Government to look at regulating the largely fragmented industry with very low entry barriers.

The move is timely. There has been a significant rise in sales and values in recent years – and a new boom seems on the starting blocks – while complaints against errant agents have soared.

The Consumers Association of Singapore received 1,100 real estate-related complaints last year, 1,113 in 2007, and 991 in 2006.

‘All this while…there wasn’t an effective instrument to address the complaints,’ said Mr Mohamed Ismail, chief executive of PropNex and first vice-president of the Institute of Estate Agents (IEA).

‘The greatest weakness of the industry is that there isn’t a central body to regulate it. Because of this, agents flout the rules, knowing their rice bowls are not affected.’

Only companies or firms in the housing-agency business need be licensed by the Inland Revenue Authority of Singapore (Iras). There are 1,737 housing agencies and 25,000 to 30,000 unlicensed agents dealing in HDB or private homes.

In March, National Development Minister Mah Bow Tan said the status quo was ‘not tenable’ and that the whole system was ‘not satisfactory’. He said then that the ministry would review the framework for the real estate industry to help customers better safeguard their interests and increase the sector’s professionalism.

Property sector players say the main priority is to introduce a mandatory accreditation or licensing scheme for individual agents.

This would help check errant operators who switch from one firm to another after getting fired. They can even rejoin the industry right after getting out of jail.

The chief executive of Singapore Accredited Estate Agencies (SAEA), Dr Tan Tee Khoon, said agencies, once licensed, usually recruit several associates who work on an agreed shared commission.

‘Therefore, the industry ends up with more than 30,000 agents, (most) without sound understanding of real estate practice,’ he said. ‘It will be an insurmountable task for the industry to self-regulate when it has never been regulated.’

Added ERA Asia Pacific’s associate director Eugene Lim: ‘Agents are not our employees. They do not take a salary from us so the amount of control that we can exert is limited.’

Industry leaders also maintain that agents need to have basic qualifications and take a standardised exam.

There should also be a basic training syllabus laid down, said Mr Ismail.

The big agencies conduct regular training but there are many small companies that may not have the resources to teach agents, noted Mr Lim.

A sound model to resolve disputes and provide mediation and adjudication services for aggrieved parties must also be put in place, said Dr Tan.

It is not compulsory for agents to join the two industry bodies – the IEA and the SAEA – so customers may have no one to turn to if their agents are not association members, said Mr Chris Koh, director of Dennis Wee Properties.

The two associations have been vying for more regulatory clout since Mr Mah’s comments in March. Some players believe the Government should empower the associations – be it one or both – to run a central registration scheme for agents and help solve disputes. But others want a third party.

‘The associations can bark but cannot bite. The people who run them are all volunteers from the industry. We need a central regulatory authority that is a neutral party to enforce rules,’ said Mr Lim.

The National Development Ministry said yesterday that it will first consult the key players such as agency directors and individual agents apart from industry associations. A public consultation phase will follow, with the process wrapping up by November.

Source: Straits Times, 21 Aug 2009

New condo to get walkway to MRT station

Beach Road private housing project could set new property trend

Beach Road private housing project could set new property trend

HOW’S this for a condominium’s selling point: Near MRT station. Complete with all-weather walkway.

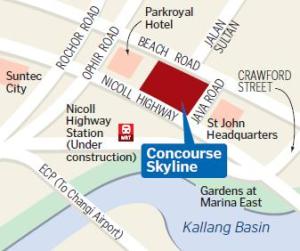

The new Concourse Skyline in Beach Road could be the first private housing project to have an overhead bridge linking it to Singapore’s mass transit system.

Other condo projects are likely to follow, in what could be an emerging trend.

Once it is completed, residents of the 99-year lease Concourse Skyline, being built on a demolished wing of the Concourse complex, will need to walk only about 200m to the Circle Line’s rebuilt (and relocated) Nicoll Highway station due to open next year.

The 360-unit condo, developed by listed property group Hong Fok at an estimated $200 million, is expected to be ready by 2013.

Concourse Skyline’s unique addition arose from rather unusual circumstances. The original Nicoll Highway station, which was much nearer to the Concourse, would have had an underground link to the former Concourse wing. But when the uncompleted station collapsed, killing four workers in a 2004 construction accident, plans for the underground link were scrapped.

A dispute then ensued between the Land Transport Authority and Hong Fok. Neither party would comment on this, but The Straits Times understands it partly involved the condo developer wanting direct access to the new station. The issue was settled last year, resulting in the overhead residential link.

Why not an underground connection?

‘The new Concourse development is no longer a commercial space, and the new MRT station is much farther away,’ explained Hong Fok director S.E. Cheong.

The project will be carried out in three stages, the first being the overhead bridge spanning Nicoll Highway. It was completed recently.

Construction of the second stage that links the overhead bridge to the MRT station, complete with lifts and escalators, is under way.

Once the Concourse Skyway nears completion, the final segment joining the condo to the bridge will be built by Hong Fok. Access to this segment will be through a secured doorway, passable only to residents.

Hong Fok had already included the linkway in publicity materials for the condo. The project was launched last year just as the impact of the world financial crisis hit Singapore. Units were then priced at between $1,500 and $1,800 per sq ft. Mr Cheong said yesterday 140 units have been sold.

City Developments’ massive $2.5 billion South Beach project – also in Beach Road and targeted to be up by 2016 – will also have mass transit links. A spokesman said the 3.5ha commercial-and-residential project will have underground links to both Circle Line and Downtown Line stations, as well as to CityLink Mall that connects to the City Hall station and Raffles City Shopping Centre.

Source: Straits Times, 21 Aug 2009

Keppel, other developers rev up for sales

KEPPEL Corporation and Keppel Land are releasing a new batch of 30 units at their Reflections at Keppel Bay condo today at an average price of $1,950 per square foot (psf), assuming buyers will take the deferred payment scheme (DPS).

Buyers who opt for the normal progressive payment scheme pay 3 per cent less. Sizes of units range from 900 sq ft to 1,600 sq ft. The 99-year development is still under construction.

Reflections at Keppel Bay comprises a total of 1,129 units, of which 638 were sold as at end-July, according to Urban Redevelopment Authority data released this week. In July alone, five units were sold at prices ranging from $1,641 psf to $2,195 psf.

Keppel is also riding on the current uptick in home buying to release for sale units at the completed Caribbean Residences nearby at an average price of $1,300-1,400 psf.

Caribbean Residences comprises a total of 168 apartments at the completed 99-year-leasehold Caribbean at Keppel Bay condo that the group had leased out as corporate residences earlier. The majority of the apartments are leased with tenancies ranging from six months to two years, and these units will be sold with the existing tenancies.

Most of the apartments at Caribbean Residences are located in two blocks which are eight and nine storeys high. So far, about 30 of the 168 units are said to have been sold in the past few weeks and the group is riding on the buyer interest to release more apartments.

‘However, not all the remaining units at Caribbean Residences are being put on the market at the same time,’ a Keppel spokeswoman said. The 30 units sold recently were mostly two-bedders.

Keppel is developing the two projects on the former Keppel Harbour site.

Property consultants say developers are working hard to release more projects, to take advantage of the pick-up in home-buying sentiment.

Next week, NTUC Choice Homes will preview its 39-storey Trevista condo in Toa Payoh. The 99-year-leasehold project will have a total of 590 units.

Singapore Land is also expected to begin selling next week Trizon, a freehold condo on the former Himiko Court site in the Mount Sinai area.

The 24-storey development comprises a total of 289 units.

SingLand bought Himiko Court in May 2007 for $336 million, or $821 psf of potential gross floor area, inclusive of an estimated $1.07 million development charge. Market watchers reckon Trizon may be priced about $1,400 psf on average.

Source: Business Times, 21 Aug 2009

Hong Kong’s 50-yr rule has marred skyline

COLLECTIVE property sales opponents like Mr Dennis Butler (‘En bloc sales: Adopt HK’s 50-year limit’, last Saturday) and Mr Augustine Cheah (‘The difference’, last Saturday) have quickly latched on to Ms Tan Hui Yee’s piece, ‘En bloc debate, HK style’ (Aug 10) and hailed it as a ‘well-argued commentary’.

Few people in Singapore know that all Hong Kong properties are on a 50-year leasehold term, beginning from the handover date July 1, 1998, except the land on which St John’s Cathedral stands in Central, which is the only freehold land in Hong Kong.

That may be one reason why the Hong Kong administration proposed a condition to lower the 90 per cent consent threshold to 80 per cent – that the building be at least 50 years old. For example, if a 30-year-old building was demolished after a collective sale, the remaining lease on the land would be below 20 years.

From Hong Kong’s international airport, you take a ride through the scenic beauty of the New Territories. Then you pass through downtown Kowloon and Hong Kong Island on the way to Central, and your opinion changes as you see many dirty and derelict buildings along the way. Many note that Hong Kong is a city of great contrast: modern skyscrapers exist side by side with rundown buildings.

With Mr Butler’s suggestion of a 50-year age limit before a collective sale can take place, the Hong Kong scenario could well be part of our skyline in time to come.

Still, I believe buildings under 20 years old, in particular those under 10 years old, should be barred from collective sales unless there are structural problems.

Mr Butler and Mr Cheah latch on to a comment from a Hong Kong letter writer: ‘Making a profit for developers is not a public purpose.’ I do not dispute the sentiment but I am surprised they left out those who also make money: home owners who sell out, voluntarily or not.

There have been more than 100 collective sales in Singapore over the years, with 80 to 90 per cent consenters and 10 to 20 per cent objectors in each sale. Thus the proportion of proponents to opponents is four to one or higher. I hope the authorities will take note of this point if they see fit to fiddle with the collective sales rules yet again.

Ace Matthews

Source: Straits Times, 21 Aug 2009

Rights of all owners adequately protected

I REFER to last Saturday’s letters by Mr Dennis Butler (‘En bloc sales: Adopt HK’s 50-year limit’) and Mr Augustine Cheah (‘The difference’).

In 1999, the Land Titles (Strata) Act was amended to allow collective property sales by majority consent. One of the key considerations in this amendment was to facilitate urban renewal and avoid situations where a small minority of owners can hold up the sale of the development where the use of the land could be optimised.

We have taken steps under the Act to ensure the rights of all owners are adequately protected and provide recourse for those who feel aggrieved for any reason. For example, all collective sales applications have to be considered by the Strata Titles Board. Minority owners who object to the sale can raise their objections to the board, and the board is required to consider these objections before it decides on the outcome of the sales application.

In 2004 and 2007, we refined and updated the Act to provide more safeguards to owners in a collective sale process. For example, owners will have a mandatory five-day cooling-off period after signing a collective sales agreement to reconsider their consent.

Mr Butler has suggested that only developments that are more than 50 years old should be considered for collective sale redevelopment. It would be too rigid to set such an age limit. There could be other factors that warrant redevelopment like its state of disrepair. It is better to leave it to the owners in each development to determine the viability and timing of collective sales.

The current policy has resulted in a better use of our limited land to create more quality housing units for Singaporeans.

For example, the 390-unit Goldenhill Park Condominium sits on the site formerly occupied by the 95-unit Goldenhill Condominium; and the 100-unit The Ansley used to be occupied by the 44-unit Mandalay Court. These former developments were less than 50 years old at the time of the collective sale and redevelopment – Goldenhill Condominium was 15 years old and Mandalay Court was 31 years old. Collective sales also offer a viable alternative for owners to seek new accommodation with new and better facilities.

We thank Mr Butler and Mr Cheah for their feedback. The Ministry of Law will continue to monitor the impact of collective sales rules, and would review the law as and when appropriate.

Chong Wan Yieng (Ms)

Head (Corporate Communications)

Ministry of Law

Source: Straits Times, 21 Aug 2009

MND regulatory framework for property agents

Ministry to launch industry and public consultation exercises from next month

(SINGAPORE) The Ministry of National Development (MND) said yesterday it will start consultations for a new regulatory framework for the real estate industry – a move that was widely welcomed.

Over the past few years, property agents here have come under fire for not having the right qualifications and for unethical practices.

In March this year, for example, Minister for National Development Mah Bow Tan said the status quo was ‘not tenable’ and the system was ‘not satisfactory’.

To tackle the problem, MND will launch an industry consultation exercise and engage various stakeholders from next month. Parties that will be consulted include industry associations, agency directors and individual agents, the ministry said.

There are two objectives: To help consumers better safeguard their interests and to boost the professionalism of the real estate industry.

This will be followed by public consultation. The entire consultation process is expected to be completed by November and key elements of a new regulatory framework are expected to be ready by December.

‘Over the past months, MND and other agencies have been studying ways to strengthen the regulatory framework, which include getting real estate agencies to take greater responsibility for the actions of their agents,’ MND said in a statement.

‘Other areas to be studied include qualifications and training requirements to increase professionalism, an improved dispute resolution mechanism and an enforcement framework against agencies with errant agents.’

MND’s move comes even as real estate agent groups here push to improve the professionalism of property agents. The industry is now largely self-regulated, but players have said the voluntary system is no longer working.

‘We have been looking forward to this consultation for a while,’ said Singapore Accredited Estate Agencies (SAEA) chief executive Tan Tee Khoon. ‘The real estate industry here has been fragmented and unregulated for a long time.’

He believes a basic regulatory framework from the government is essential so the industry can then use it to self-regulate. SAEA, for its part, has accredited about 7,000 of the estimated 30,000 property agents here.

But Dr Tan says more is needed. In particular, a dispute resolution system that can deal with complaints from the public and ensure that genuine complains against errant agents are addressed is essential, he said.

Property agencies also welcomed the consultation. PropNex, which employs more than 5,000 real estate agents here, said a central registry of agents – from which those with a black mark can be struck off – is a must.

‘We all know that the current state of affairs is not adequate,’ said PropNex chief executive Mohamed Ismail. ‘Agents who have flouted the rules at one agency can just join another now. There is no way of stopping them from practising.’

In its statement, MND said that while the government works on a new regulatory framework, individual tenants and home buyers must also exercise greater care and responsibility.

‘Working with other agencies, MND will look into various public education efforts to equip consumers with the knowledge to conduct their real estate transactions prudently and with due diligence,’ the ministry said.

Source: Business Times, 21 Aug 2009

Leave a Comment

Leave a Comment